Developing a Consumer Law Practice

-

Register

- Nonmember - $455

- Private Attorney Member - $210

- Legal Aid Member - $210

Webinars

• Building your FDCPA Practice Using your Current Stock of Consumer Debt Work

• Developing an Auto Fraud Practice Part 1

• Developing an Auto Fraud Practice Part 2

• How Consumer Law Specialties Choose You

• How to become a Successful Student Loan Lawyer

• How to set up a Successful Mortgage Practice

• Triage Your FCRA Practice

Why These Videos Are Helpful

Are you considering starting your own consumer law firm or have you just recently started your firm? Are you thinking about transitioning into another sub-specialty of consumer protection law? In this webinar series, you will learn what factors to consider when deciding which practice areas to choose when expanding your consumer practice. You will also learn the basics of setting up a mortgage, auto, FDCPA, student loan, and FCRA practice. This webinar series is geared to beginners in consumer law.

What You Will Learn

• How to determine which consumer law practice area best fits your budget, and your lifestyle.

• How to perfect client selection, price cases appropriately, secure attorney fees, and take advantage of developments in the law under Dodd-Frank and Chapter 13 in mortgage cases

• How to develop FDCPA claims in bankruptcy cases and find simple and common FDCPA claims in debt defense cases

• How to spot good cases, create great cases, and prepare your practice and business for a growing FCRA caseload

• How to set up an auto fraud practice and find viable cases

-

Contains 3 Component(s), Includes Credits Recorded On: 04/18/2024

In this webinar, the presenters will discuss the practicalities of choosing specific practice areas in which to grow or expand, or, in some cases, which to leave.

Are you considering or have you just started your own firm? Are you new to consumer protection law? Are you thinking about transitioning to a new sub-specialty within consumer protection law? In this webinar, the presenters will discuss the practicalities of choosing specific practice areas in which to grow or expand, or, in some cases, which to leave.

What You Will Learn:

• Techniques to assist you in choosing specific areas of consumer protection law for growing or expanding your practice.

• Moral, personal, financial, and other practical information on the many different areas of consumer law, with advice and guidance so you can find the best fit for yourself, your budget, and your lifestyle.

• How to market yourself, your skills, and your practice areas to clients and lawyers in your area.

Kristin Kemnitzer

Kemnitzer, Barron & Krieg, LLP

Kristin Kemnitzer is a managing partner at Kemnitzer Barron & Krieg, LLP. The firm’s practice focuses on protecting consumers from economic injustice through both individual cases and class actions. Kristin brings cases involving solar panel fraud, lemon law, auto fraud, unfair debt collection, illegal repossessions, motorcycle finance, elder abuse, door-to-door sales scams, and California’s mortgage anti-deficiency statutes. KBK has represented thousands of consumers in individual cases, and hundreds of thousands of consumers in class actions. KBK attorneys have been appointed lead counsel over 250 class actions. They have represented over half a million class members, have obtained recovery of over $500 million for California consumers, and have extinguished over $3 billion in alleged deficiency balances following the sale of repossessed vehicles. Kristin graduated with honors from Stanford University in 2006 and obtained her law degree from the University of California, Berkeley, School of Law in 2011.

Andrew Milz

Flitter Milz, P.C

Andy Milz is a trial lawyer at Flitter Milz, PC with offices in Pennsylvania, New Jersey, and New York (www.consumerslaw.com). Andy represents victims of consumer finance fraud, inaccurate credit reporting, wrongful repossessions, and civil rights abuses in individual and class action matters. Andy is a contributing author to Carter, et al., Pennsylvania Consumer Law (Bisel Pub. Co., Supp. 2023) and treatises published by National Consumer Law Center (“NCLC”) including Repossessions (NCLC 2021), the foremost treatise on the subject. He has lectured nationally on consumer law, and is an active member of the National Association of Consumer Advocates (“NACA”). In 2022, Community Legal Services of Philadelphia awarded Andy and his firm an Equal Justice Award recognizing their excellence in consumer protection law and history of assistance given to low-income consumers. Andy is a graduate of King’s College (BA), the University of Scranton (MA), Temple University School of Law (JD), and the Gerry Spence Trial Lawyers College in Wyoming. He teaches Consumer Law and Litigation at Temple Law School.

-

Contains 3 Component(s), Includes Credits Recorded On: 04/23/2021

Learn how to set up your FCRA practice

Learn how to set up your FCRA practice

James Francis

Co-Founder

Francis Mailman Soumilas, P.C.

James Francis (Muhlenberg College, B.A. 1992; Temple University, J.D. 1995) has focused on consumer protection litigation, concentrating on the FCRA, FDCPA, and consumer class actions. He was trial counsel in the Ramirez case, argued the seminal FCRA case of Cortez v. TransUnion before the 3rd Circuit Court of Appeals, was certified to serve as Class counsel in over thirty class actions, was involved in the trial of two class actions to verdict and has received some of the largest FCRA settlements in history.

Jeffery Sand

Attorney at Law

Weiner and Sand

Jeff Sand spent the first six years of his career as a defense lawyer at two of the country's premier defense firms, where he defended Fortune 500 companies in class action and single-plaintiff lawsuits. In 2014, Jeff left his defense practice to represent employees and consumers, rather than large corporations. Jeff's consumer rights law practice focuses on litigation under the FCRA, including claims for credit reporting errors, employment background reports, tenant screening reports, and identity theft. Jeff's FCRA experience focuses on both class actions as well as single-plaintiff lawsuits.

-

Contains 3 Component(s), Includes Credits Recorded On: 02/12/2020

How to spot viable auto fraud claims

Besides purchasing a home, buying a car is the biggest consumer purchase that most individuals will make in their lifetime. Today, there are there are more than 260 million registered vehicles in the United States alone. This number is only growing. The automotive industry is ripe with fraud and pitfalls for unwary consumers. Fortunately, there are several federal and state statutes that serve as tools for consumer attorneys to help rectify the wrongs in the industry and advocate for their consumers.

This two-part webinar series is aimed at consumer attorneys who are either starting a new practice or looking to expand into the area of auto fraud. Part One will focus on the obstacles to getting started, how to set up a new auto fraud practice, and considerations to keep in mind in choosing cases. Part Two will focus on claims and venue, how to find new cases, and tips and tricks for litigation and settlement.

What You Will Learn

• How to set up an auto fraud practice

• How to find viable auto fraud cases

• Tips and tricks for auto fraud litigation

Elliot Conn

Founder

Conn Law, PC

Elliot Conn is the founder of Conn Law, PC, a California consumer protection law practice headquartered in San Francisco. Elliot has successfully litigated hundreds of consumer cases, both individual cases and class actions. Through his class actions and other complex cases, Elliot has been successful in eliminating over $1 billion in consumer debt on behalf of hundreds of thousands of Californians. Elliot's cases have also put millions of dollars back in consumers' pockets, nationwide. Elliot is AV Martindale-Hubbell rated. Elliot is a graduate of the University of California, Berkeley, School of Law and received his Bachelors of Arts from Colgate University.

Adam Taub

Founder

Adam G. Taub & Associates Consumer Law Group

Adam G. Taub is the co-founder of Adam G. Taub & Associates Consumer Law Group, PLC, a Michigan consumer protection law practice located in Southfield, Michigan, a suburb of Detroit. Adam has represented hundreds of victims of auto Fraud since 1998. His practice focuses exclusively on representing consumers against car dealers, banks, credit card companies, mortgage lenders, credit reporting agencies, and debt collectors. He is a graduate of Wayne State University Law School and received his Bachelor’s degree from Wesleyan University.

-

Contains 3 Component(s), Includes Credits

How to spot viable auto fraud claims

Besides purchasing a home, buying a car is the biggest consumer purchase that most individuals will make in their lifetime. Today, there are there are more than 260 million registered vehicles in the United States alone. This number is only growing. The automotive industry is ripe with fraud and pitfalls for unwary consumers. Fortunately, there are several federal and state statutes that serve as tools for consumer attorneys to help rectify the wrongs in the industry and advocate for their consumers.

This two-part webinar series is aimed at consumer attorneys who are either starting a new practice or looking to expand into the area of auto fraud. Part One will focus on the obstacles to getting started, how to set up a new auto fraud practice, and considerations to keep in mind in choosing cases. Part Two will focus on claims and venue, how to find new cases, and tips and tricks for litigation and settlement.

What You Will Learn

• How to set up an auto fraud practice

• How to find viable auto fraud cases

• Tips and tricks for auto fraud litigation -

Contains 3 Component(s), Includes Credits Recorded On: 12/05/2019

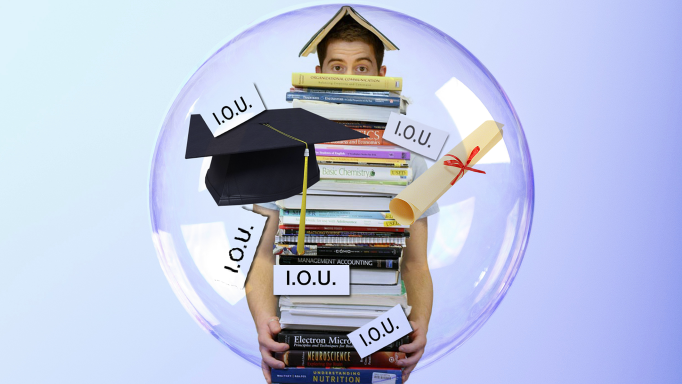

How to identify a student loan problem from your current client list

There are 1.6 trillion dollars in outstanding student loans in the U.S. that affect forty-four million Americans. As attorneys, we need to have a basic knowledge of how to assist our clients in the handling of this type of debt and how to best explain options.

The student loan problem is often very confusing and misunderstood by the student loan borrower as well as the public in general. The student loan debt problem is multi-generational, and potential clients are present in all age groups

This webinar is particularly relevant for practitioners who advise consumers, consumer advocates, bankruptcy attorneys, and debt defense attorneys.

What You Will Learn

• How to identify a student loan problem from your current client list

• What options exist for resolution of the debt

• How to monetize a student loan case

• How to promote your student loan niche

D.J. Rausa

Founder

The Law Offices of D.J. Rausa

D.J. Rausa is a bankruptcy and student loan lawyer. Upon graduating from high school, Mr. Rausa enlisted in the United States Navy. He served two Tours of Duty from 1975 until 1983, after which time he was Honorably Discharged. Mr. Rausa graduated from San Diego City College with two associate degrees. He received his law degree from Western Sierra Law School in 1989. He has specialized in bankruptcy law for over twenty-seven years. Mr. Rausa is knowledgeable about the laws that govern how student loans are processed and the policies implemented under the Higher Education Act. He is well versed in the Code of Federal Regulations that govern the student loan servicers and their collection agencies. He has integrated and monetized student loan debt resolution into his consumer bankruptcy practice since 2014. Mr. Rausa has recently relocated to the greater Nashville area and practices bankruptcy and student loan law in the Middle District of Tennessee.

-

Contains 3 Component(s), Includes Credits Recorded On: 08/31/2017

How to perfect client selection so you and your client are in sync

Dodd-Frank Mortgage Servicing Rules, alone or in conjunction with Chapter 13 Bankruptcy, are effective tools to assist homeowners with mortgage-related financial problems. You have heard about the rules but how do you avoid having Chapter 7 as your own exit strategy? This webinar is for those practitioners who cannot resist these legal challenges but still need or want to make a living.

What You Will Learn• How to perfect client selection so you and your client are in sync

• How to price the case and choose a balance of case types to make a profit helping homeowners

• How to secure payment of attorney's fees in these cases

• How to take advantage of developments in the law under Dodd-Frank and Chapter 13 to ensure a successful outcome for you and your clients

Christine Wolk

Attorney at Law

Ms. Christine Wolk has been practicing law in the state of Wisconsin since 1983. In 1995, she left her law firm and forged her own trail in bankruptcy. In 2003, Ms. Wolk added consumer mortgage defense to her portfolio. Ms. Wolk has earned herself a local reputation in this mortgage niche in both state court foreclosures (judicial) and representing Chapter 13 debtors

-

Contains 3 Component(s), Includes Credits Recorded On: 06/25/2015

In this webinar, the presenters will discuss the practicalities of choosing specific practice areas in which to grow or expand, or in some cases, which to leave.

Are you considering or have you just started your own firm? Are you thinking about transitioning into another sub-specialty of consumer protection law? In this webinar, the presenters will discuss the practicalities of choosing specific practice areas in which to grow or expand, or in some cases, which to leave.

What You Will Learn

• Techniques to assist you in choosing specific areas of consumer protection law for growing and expanding your practice.

• Moral, personal, financial, and other practical information on the many different areas of consumer law, with advice and guidance so you can find the best fit for yourself, your budget, and your lifestyle.

Robert F. Brennan

Founder

The Law Offices of Robert F. Brennan

Robert F. Brennan, Esq. has been practicing law for thirty-five years and was one of the very first members of the National Association of Consumer Advocates. He served as the California state chair for NACA for close to a decade in the early 2000s. He is a veteran of over seventy-five civil jury trials with a record of having won a large majority of them. He has been handling Fair Credit Reporting Act cases since the late 1990s. For many years, his verdict in Park City v. Ford (Superior Court, Riverside County) was the largest single verdict in a California Song-Beverly “lemon law” case. He has also had noteworthy verdicts in personal injury, medical malpractice, legal malpractice, and commercial real estate jury trials.

Dana Karni

Lone Star Legal Aid

Dana Karni founded Karni Law Firm, P.C. in July of 2007 and has since been tirelessly pursuing and finding success for her clients in many areas of consumer law. Dana began her consumer rights career handling debt collection defense cases, as well as plaintiff’s debt collection abuse lawsuits. Over the past three years, Dana has transitioned her law practice to include auto fraud cases. Early in 2018, Dana won her first federal jury trial pursuing a used car dealer for odometer fraud.

-

Contains 3 Component(s), Includes Credits Recorded On: 09/20/2017

Learn to identify the opportunities for income-generating FDCPA cases you may already have in your files.

If you have a consumer bankruptcy or debt defense practice, this webinar is for you. Our speakers will help you identify the opportunities for income-generating FDCPA cases you may already have in your files. Find the low-hanging fruit that these practice areas provide and learn how to build an FDCPA practice from the ground up.

What You Will Learn• How to develop FDCPA claims in bankruptcy cases

• How to find simple and common FDCPA claims in debt defense cases

• How to avoid pitfalls while building your practice.

Terry Lawson

Legal Services of Eastern Missouri

Terry Lawson runs a consumer-focused law firm in Kansas City, MO with practice in both state and federal courts. He provides consumers with debt defense and does some consumer bankruptcy work as a complement to his other practice areas. He also has a busy consumer protection practice including FDCPA, TILA, FCRA and other federal claims, state law/UDAP work, and other plaintiff work. A significant and growing part of his practice is student loan law, which includes assisting borrowers with understanding payment options, facilitating rehabilitation of loan defaults, and suing student loan collectors that violate borrower rights.

John Steinkamp

John Steinkamp & Associates

John Steinkamp has been a practicing lawyer in Indianapolis, IN for eighteen years. His practice, John Steinkamp & Associates, does consumer bankruptcy work and consumer litigation. His office has filed more than 650 FDCPA lawsuits since 2009. A former family law attorney, he has participated in over 300 trials and over 100 mediations. Overall, John has been an attorney in more than 4,000 cases.

-

Contains 4 Component(s), Includes Credits

If you are getting calls about solar fraud but have not yet taken on any cases, or if you have started taking these cases, but want to learn more, this webinar is for you.

If you are getting calls about solar fraud but have not yet taken on any cases, or if you have started taking these cases, but want to learn more, this webinar is for you. The presenters, one with a significant bulk of his practice in solar fraud and one new to this area, will discuss the basics about how the solar industry works, common financing models, common fact patterns, common defenses, and things to watch out for, both good and bad.

Please note that the webinar will be followed by a one-hour online discussion. When you register you will receive two reminders, one for the webinar at 2pm and one for the online discussion at 3pm ET.

What You Will Learn

* Why solar fraud cases can be great cases and how you can ease into this area

* What are the different types of solar fraud cases that are out there and how to recognize good cases and good clients

* What are the potential pitfalls and benefits with solar fraud cases

Rob Treinen

Rob Treinen has practiced consumer protection law almost exclusively since 1999 when he graduated from University of Minnesota Law School and took his first job at Legal Aid in Gallup, New Mexico. For the past 13 years, he has run Treinen Law Office in Albuquerque where he is the sole attorney but blessed with a great staff. He has presented at CLEs across the country on consumer law topics. In 2016, he graduated from the Trial Lawyers College. He loves his wife and kid, loves to travel, and still loves his job. Solar fraud cases are his newest passion, making up about half of his cases for the past few years.

John Ellem

John N. Ellem received his law degree from the WVU College of Law in 1992. He opened Ellem Law Office, PLLC in July 2000, where his focus is on consumer protection law in WV and OH including lemon law, debt collection abuse, FCRA violations and now solar panel fraud. He is also involved in human rights work as President of Human Rights for Kids. Mr. Ellem had the privilege of serving 14 years as a member of the West Virginia House of Delegates. Along with his wife and daughter, he enjoys traveling, hiking, and fly-fishing. He has an active yoga practice and is a registered yoga teacher (RYT 500) through Yoga Alliance and currently teaches yoga at his local YMCA, and at Snowshoe Resort.